Arizona Form A-4 2025

Arizona Form A-4 2025. Employers are required to make the new form available to employees by january 31,. Effective january 31, 2023, employers must provide arizona employees with an updated.

20 rows withholding returns must be filed electronically for taxable. You can use your results from.

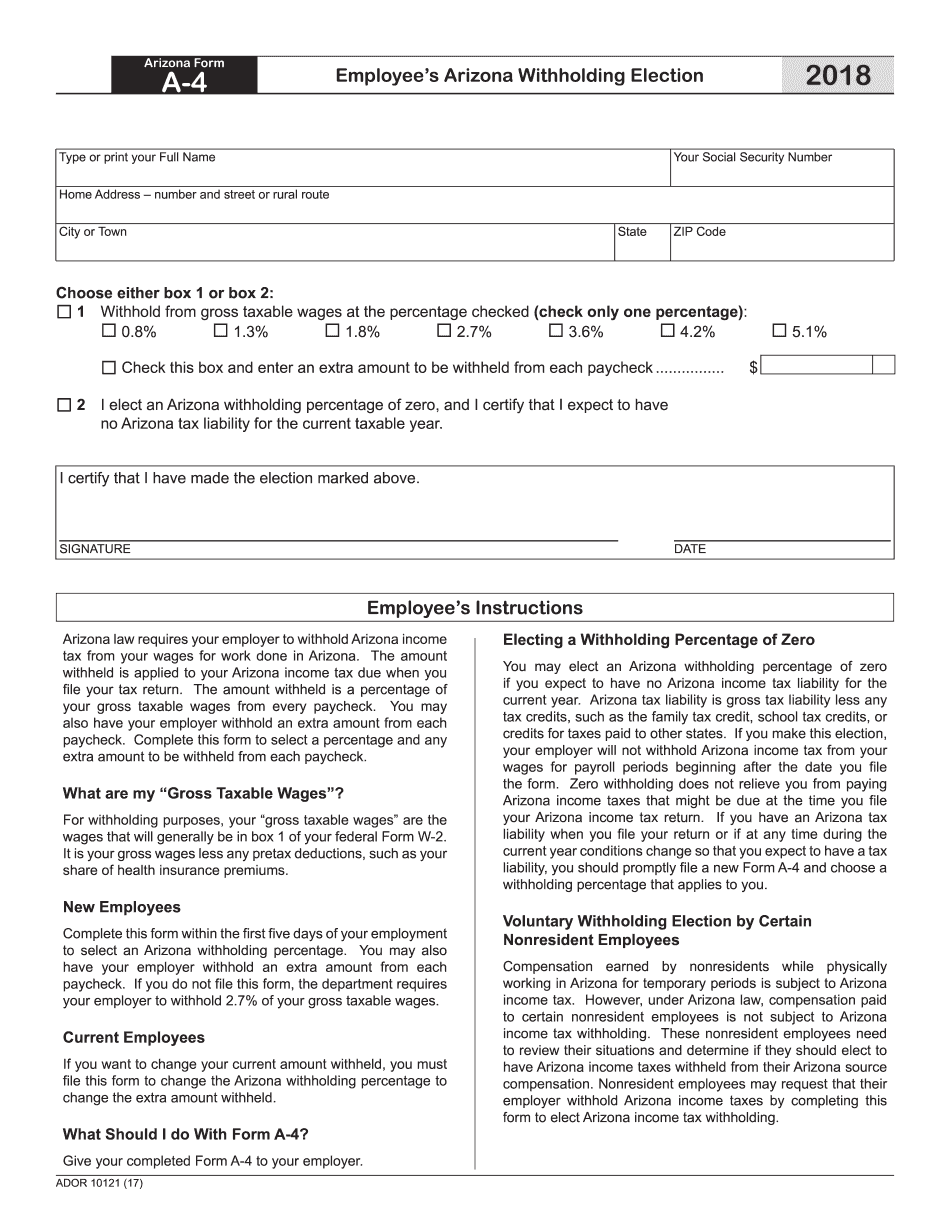

The Updated Form Reflects The New Lower Rates.

Arizona tax rates have decreased for 2023.

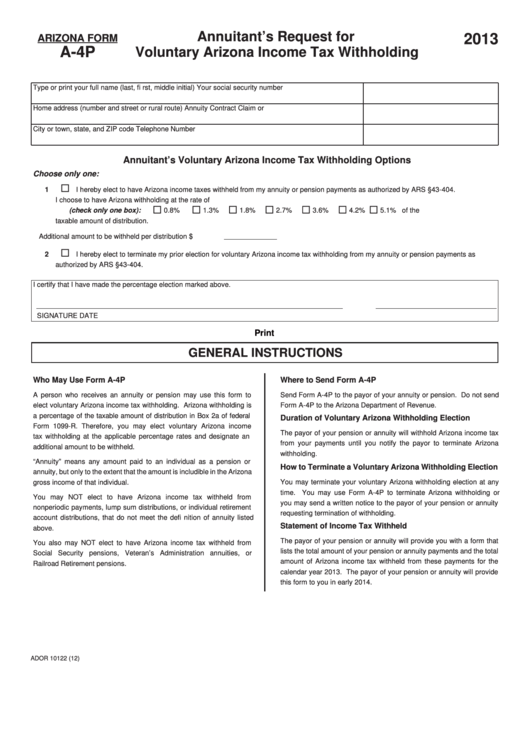

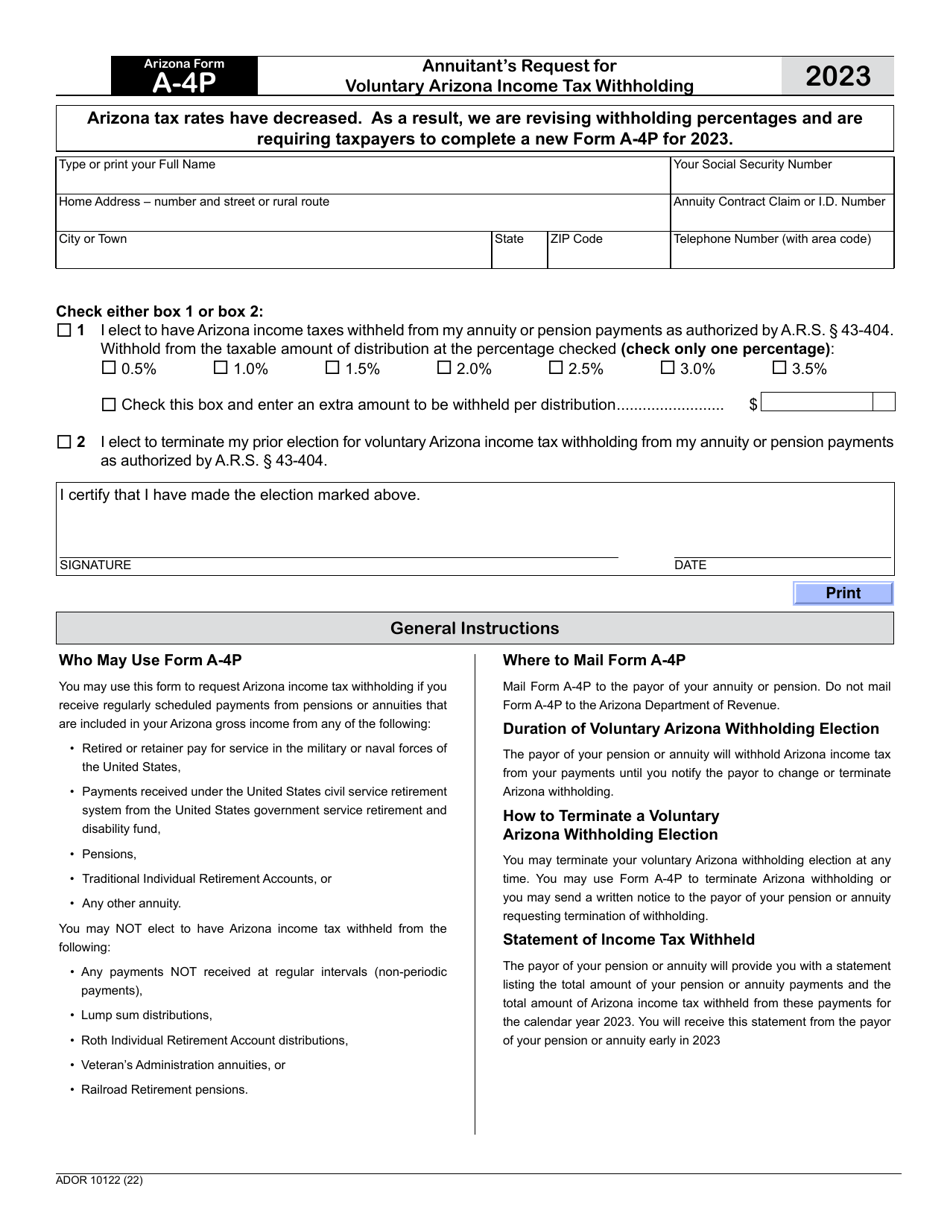

Annuitant's Request For Voluntary Arizona Income Tax Withholding.

Arizona law requires your employer to withhold arizona income tax from your wages for work done in arizona.

Arizona Form A-4 2025 Images References :

Source: formspal.com

Source: formspal.com

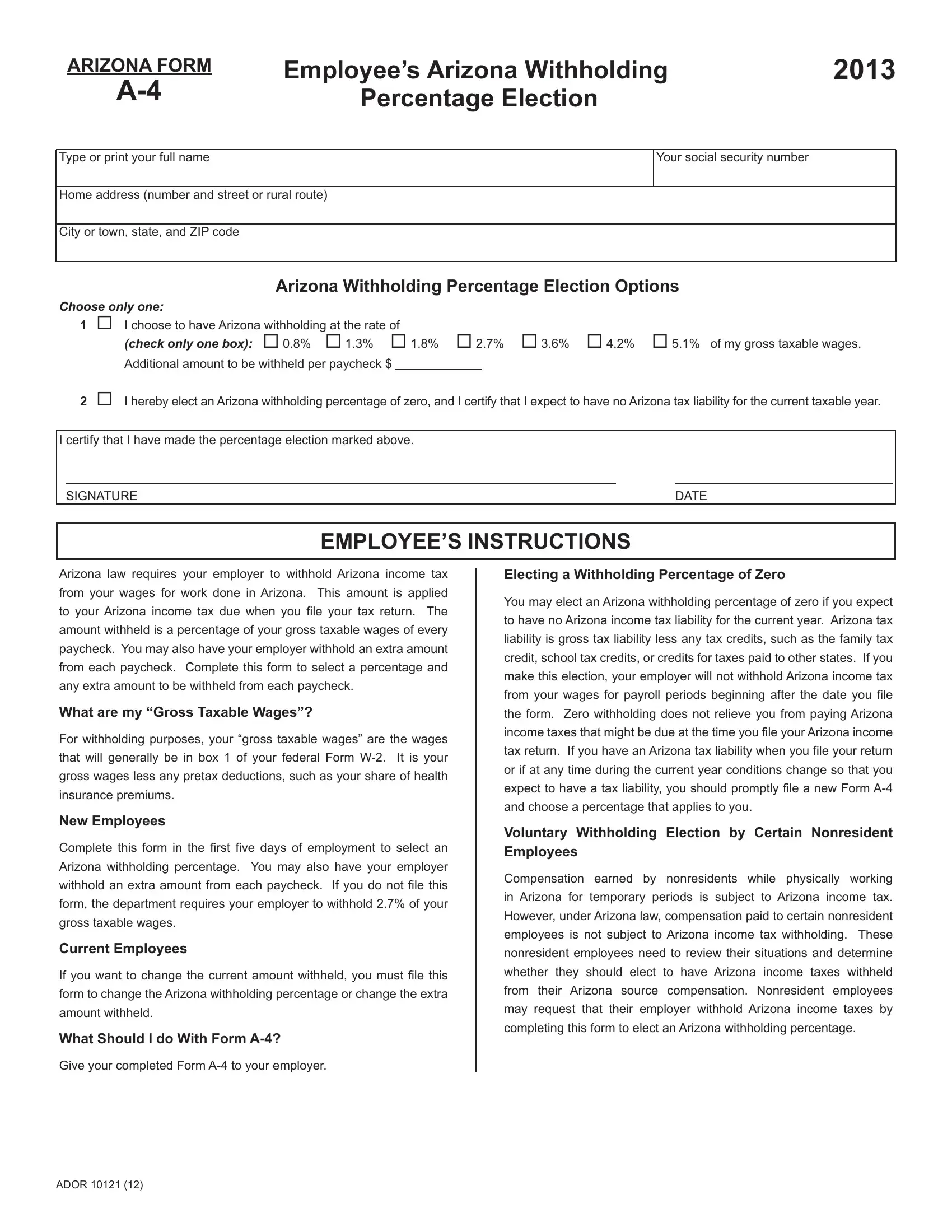

Arizona Form A 4 ≡ Fill Out Printable PDF Forms Online, Residents who receive regularly scheduled payments from payments or annuities. The default rate for employees.

Source: www.taxuni.com

Source: www.taxuni.com

Arizona Form A4 2023 2025, This amount is applied to your arizona income tax due when you. Residents who receive regularly scheduled payments from payments or annuities.

Source: w4-form-2018-printable.com

Source: w4-form-2018-printable.com

Arizona A4 Form 2023 Printable AZ W4 Form, Arizona law requires your employer to withhold arizona income tax from your wages for work done in arizona. Employers are required to make the new form available to employees by january 31,.

Source: www.templateroller.com

Source: www.templateroller.com

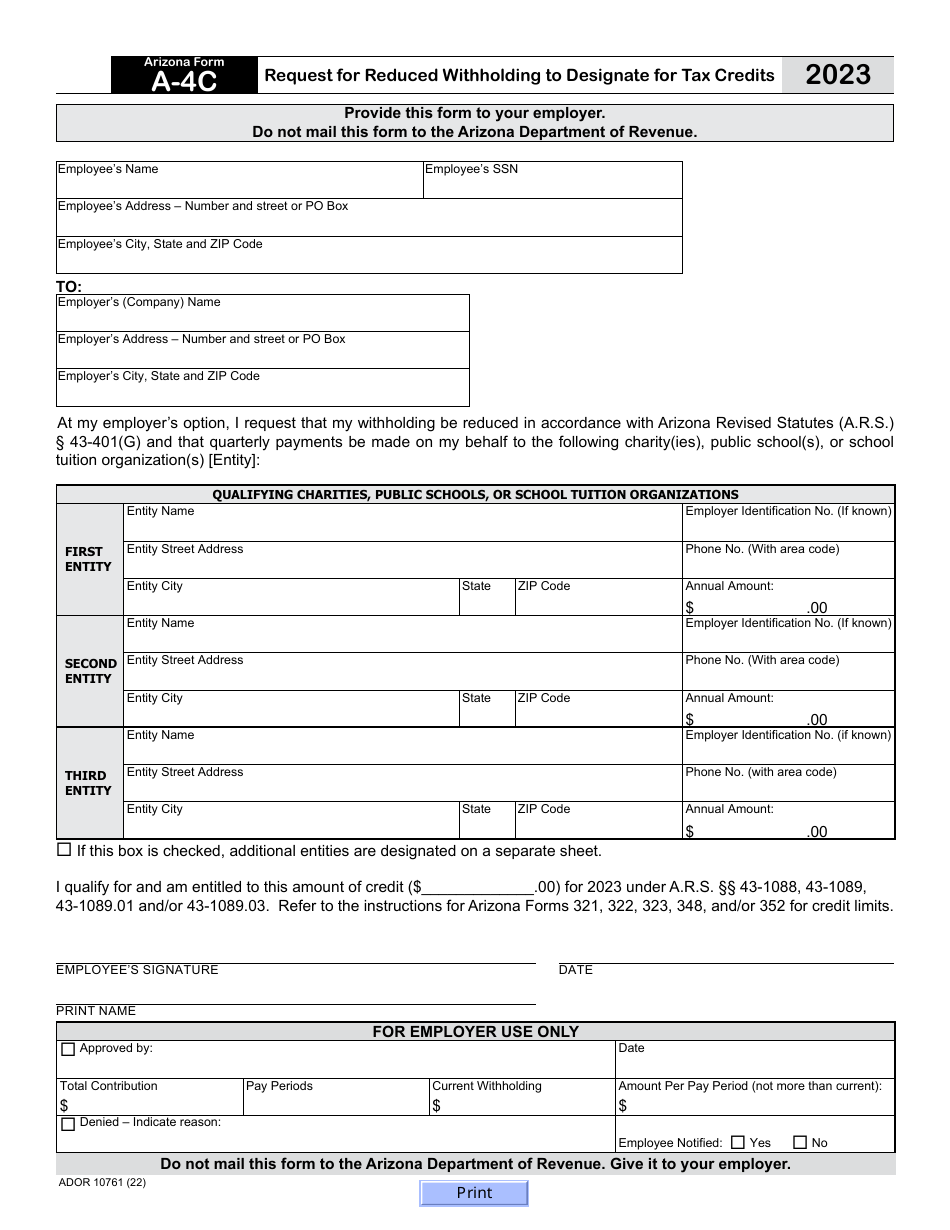

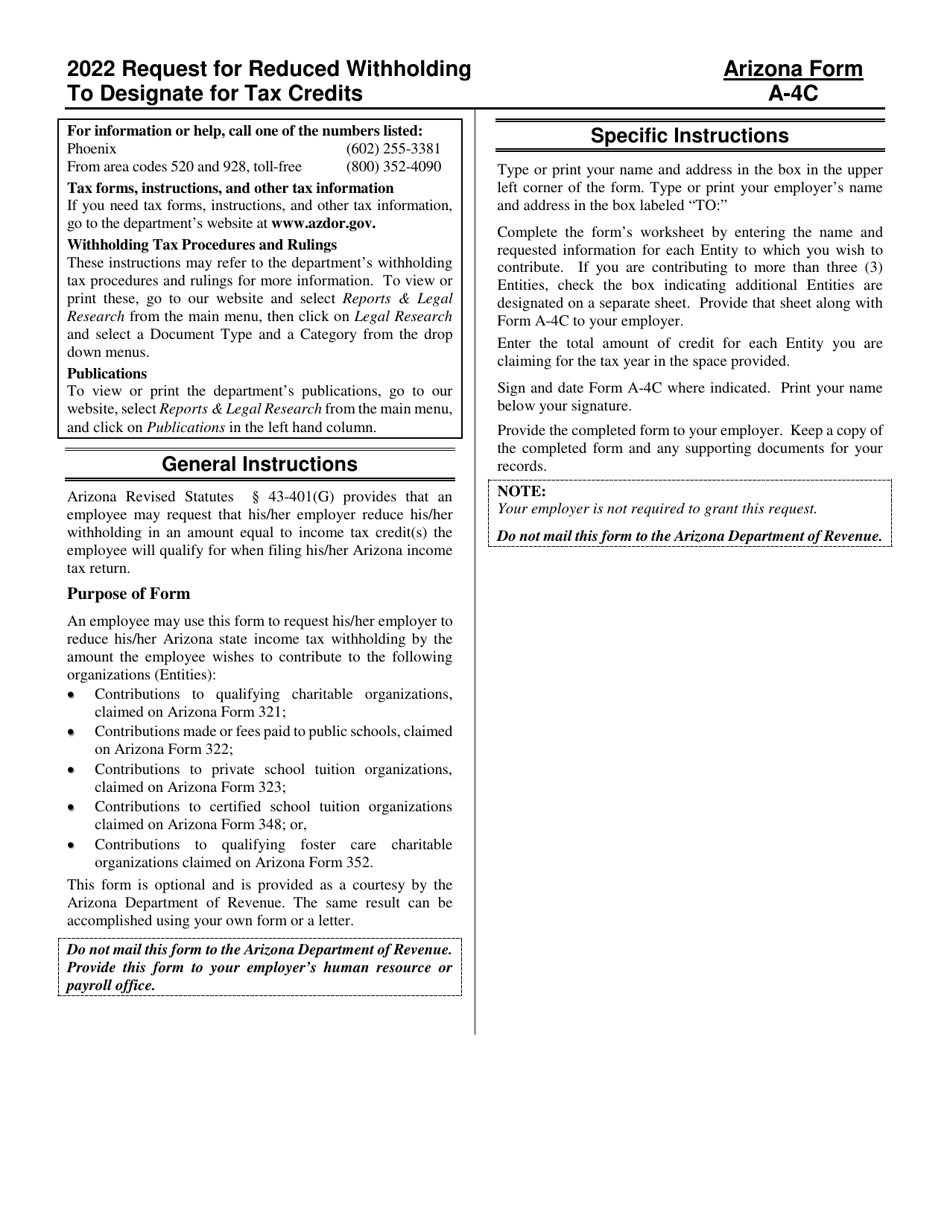

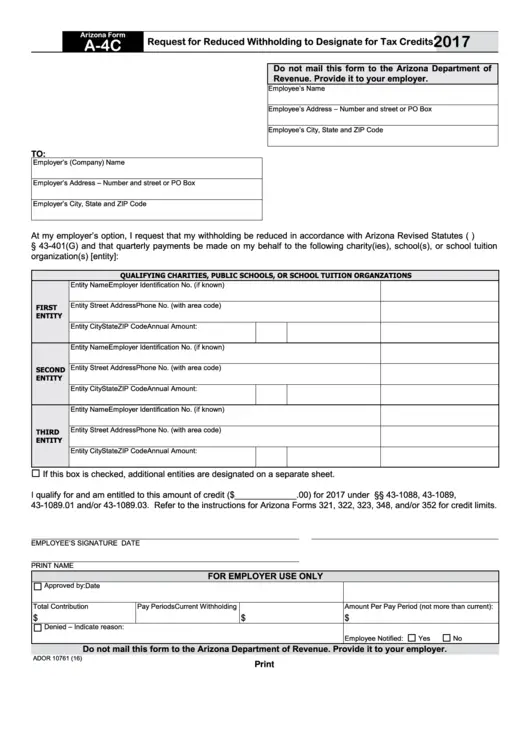

Arizona Form A4C (ADOR10761) Download Fillable PDF or Fill Online, Arizona law requires your employer to withhold arizona income tax from your wages for work done in arizona. Annuitant's request for voluntary arizona income tax withholding.

Source: www.withholdingform.com

Source: www.withholdingform.com

Mo Form For Withholding Taxes For Pension, Arizona tax rates have decreased for 2023. The updated form reflects the new lower rates.

Source: www.templateroller.com

Source: www.templateroller.com

Download Instructions for Arizona Form A4C, ADOR10761 Request for, The updated form reflects the new lower rates. Complete the form and submit it to your employer or your employer’s payroll department.

Source: printableformsfree.com

Source: printableformsfree.com

2023 Arizona State Withholding Form Printable Forms Free Online, Employers are required to make the new form available to employees by january 31,. If you want to change your current amount withheld, you must file this form to change the arizona withholding percentage or to change the extra amount.

Source: formspal.com

Source: formspal.com

Arizona Form A 4 ≡ Fill Out Printable PDF Forms Online, Effective january 31, 2023, employers must provide arizona employees with an updated. Annuitant's request for voluntary arizona income tax withholding.

Source: www.formsbank.com

Source: www.formsbank.com

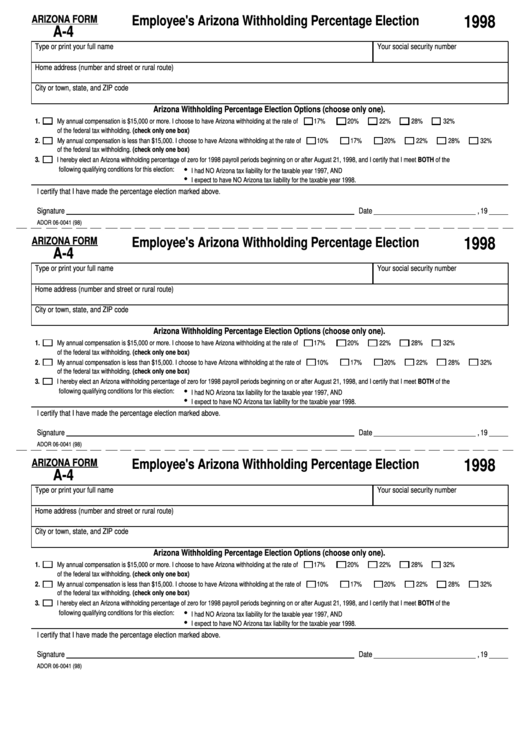

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage, Arizona’s individual income tax rates were substantially reduced starting with the 2022 tax year. Employers are required to make the new form available to employees by january 31,.

Source: www.templateroller.com

Source: www.templateroller.com

Arizona Form A4P (ADOR10122) Download Fillable PDF or Fill Online, The updated form reflects the new lower rates. Residents who receive regularly scheduled payments from payments or annuities.

By January 31, 2023, Every Arizona Employer Is.

The default rate for employees.

Residents Who Receive Regularly Scheduled Payments From Payments Or Annuities.

If you want to change your current amount withheld, you must file this form to change the arizona withholding percentage or to change the extra amount.

Category: 2025